Digital Archiving: Everything You Need to Know

Veröffentlicht am 22.01.2026

Lesedauer: 10 min

Contents

- What is Meant by Digital Archiving?

- How Does Digital Archiving Work?

- Advantages of Electronic Archiving

- Challenges & Possible Solutions

- The Different Forms of Digital Archiving Explained

- Electronic Archiving from the Perspective of Legal Requirements

- Which Documents Should be Archived?

- Digital Archiving Process

- Which Archiving Software is the Best?

- FAQs: Frequently Asked Questions About Digital Archiving

Inhalt

- What is Meant by Digital Archiving?

- How Does Digital Archiving Work?

- Advantages of Electronic Archiving

- Challenges & Possible Solutions

- The Different Forms of Digital Archiving Explained

- Electronic Archiving from the Perspective of Legal Requirements

- Which Documents Should be Archived?

- Digital Archiving Process

- Which Archiving Software is the Best?

- FAQs: Frequently Asked Questions About Digital Archiving

What is Meant by Digital Archiving?

Digital archiving refers primarily to the systematic, structured, and long-term storage of documents in an electronic archive. The requirements that apply depend on the purpose of the documents. As soon as documents are subject to legal retention requirements, digital archiving must be implemented in such a way that the integrity, traceability, completeness, and availability of the documents are guaranteed throughout the entire retention period, i.e., the archiving is audit-proof. In a business context, audit-proof archiving is usually mandatory, which is why in practice the term digital archiving is often equated with audit-proof archiving.

Requirements for digital and audit-proof archiving include:

- Structured storage with unique metadata

- Access concepts and permissions

- Protection against subsequent changes

- Defined retention and deletion periods

- A technical solution such as a document management or ECM system

It does not matter whether the documents were originally digital or previously paper-based.

We have also summarized all the basic information on audit-proof archiving in a glossary entry.

How Does Digital Archiving Work?

When archiving via a document management or ECM system, documents are centrally captured, indexed, versioned, and stored in an audit-proof manner. Access, permissions, and workflow are clearly regulated.

Archiving is also possible via an external cloud system. Cloud solutions offer scalability and flexibility, but must meet the same legal requirements as on-premise systems.

Advantages of Electronic Archiving

Digital archiving offers companies numerous advantages—provided it is implemented correctly.

Space savings and scalability

Paper archives require physical storage space, incur costs, and grow uncontrollably. Digital archives, on the other hand, replace filing cabinets with structured systems and reduce space requirements enormously. The archive scales easily.

Time and cost savings

Documents can be found in seconds using the search function. This reduces manual search times, speeds up processes, and lowers administrative costs. Accounting, purchasing, and administration departments benefit from this in particular.

Location independence

Digital archives enable location-independent access to documents. This is a decisive factor for decentralized and/or international teams and for flexible working models, e.g., from home offices.

Legal certainty

When implemented correctly, digital archiving meets legal requirements such as GoBD, UGB, BAO, or GDPR. Audits by tax authorities or auditors can be carried out much more efficiently.

Transparency and traceability

Changes, accesses, and versions can be controlled and logged. This creates clear responsibilities and increases audit compliance.

Automated workflows

Interfaces to existing systems enable processes such as digital invoice processing to be automated and mapped without media discontinuity.

Challenges & Possible Solutions

Possibility of data loss

Without backup strategies or redundant systems, technical defects or cyberattacks can lead to data loss. Modern archiving solutions therefore rely on redundant storage and clear security concepts.

Initial investment costs

Companies may hesitate to invest in a digital archiving system due to the initial investment costs. However, the investment will pay for itself in the medium term. Companies that are still reluctant to make the expenditure could initially opt for a cheaper and more flexible cloud solution.

Update and maintenance costs

Digital systems must be maintained, updated, and further developed. Cloud-based or managed solutions significantly reduce the effort involved.

Documents cannot be found due to incorrect archiving

Incorrect tagging or unclear filing structures mean that documents are archived but are practically unusable. Automated indexing and clear standards counteract this.

Training new employees

Archive systems require training and clear processes. Intuitive user interfaces and structured workflows significantly reduce the effort involved.

Aging of local data carriers

Legal retention periods require audit-proof digital archiving for periods of up to 10 years, including for electronic documents. Since local data carriers are subject to natural aging, there is a risk of failure in the long term. Cloud infrastructures with redundant storage offer a high level of data security in this regard.

The Different Forms of Digital Archiving Explained

Depending on the purpose and legal requirements, there are several different forms of digital archiving.

Incoming and outgoing documents are stored digitally and filed in a structured manner. Employees usually still need these documents and access them via an internal archive system. The focus is on the retrievability of the documents. Whether requirements for long-term storage and audit compliance must also be met depends on the type and remaining purpose of the documents.

Audit-proof archiving meets all requirements of HGB, BAO, GoBD, and AO, such as immutability, complete logging, and traceability for 6 to 10 years. It is a prerequisite for commercial and tax-relevant documents.

This format ensures that documents remain legible and available for many years, even in the event of technical changes. It is used after the end of the statutory retention periods for documents.

Electronic Archiving from the Perspective of Legal Requirements

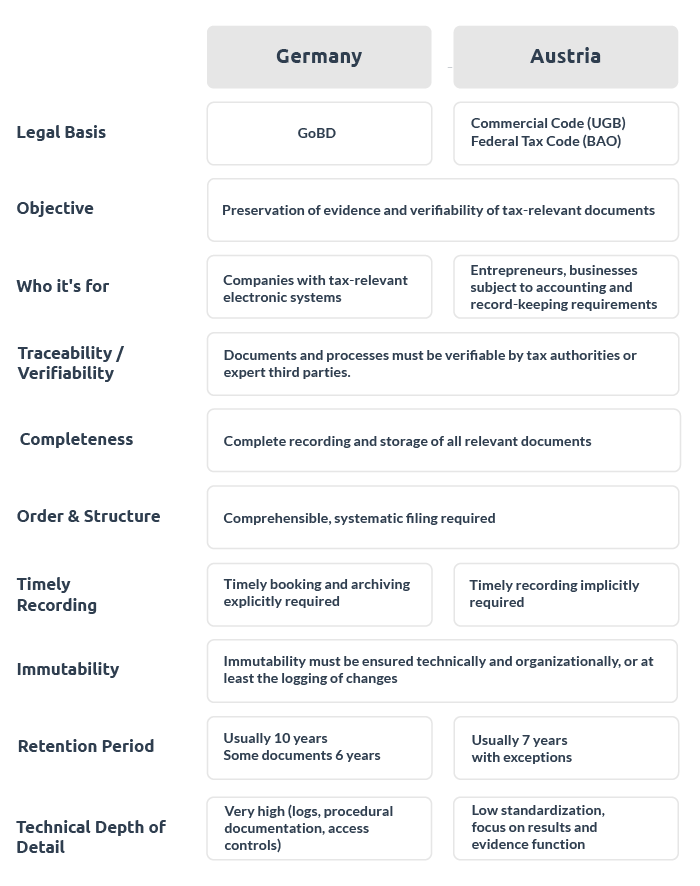

Digital archiving is regulated by clearly defined legal requirements in both Germany and Austria. The aim of these regulations is to ensure that business-related documents remain complete, traceable, and unchanged throughout the entire retention period. Although the legal basis is similar in both countries, there are differences in the details of their structure and terminology.

In Germany, the Commercial Code (HGB), the Fiscal Code (AO), and the principles of proper management and storage of books, records, and documents in electronic form (GoBD) form the relevant legal framework. These regulations define clear requirements for electronic archiving. Documents must be stored in an unalterable form, be complete and accurate in content, and be filed in an orderly structure. In addition, the legislator requires that all archived documents be available at all times during the entire retention period and can be retrieved within a reasonable time, especially in the context of tax audits.

In Austria, the Federal Tax Code (BAO) and the Commercial Code (UGB) primarily regulate the requirements for the storage of business documents. Here, too, the focus is on proper, traceable, and tamper-proof archiving. Electronically archived documents must remain legible throughout their entire retention period and be stored in a form that allows for complete traceability of business transactions.

The German GoBD is more technical and detailed, while the Austrian UGB/BAO is more principle-oriented. In practice, the requirements are very similar: those who archive in accordance with GoBD usually also comply with the Austrian requirements – but the reverse is not automatically true!

What does archiving according to UGB/BAO mean in Austria?

The following principles form the relevant framework:

Truth and clarity

Business documents must correspond to the actual economic circumstances and be clearly understandable. Entries and receipts must be archived in such a way that their content can be interpreted unambiguously and no misleading or obscuring representations arise.

Completeness

All documents subject to recording must be recorded and stored in full. No receipts may be missing or removed retrospectively. The obligation to ensure completeness applies regardless of whether documents were originally created digitally or digitized from paper form.

Traceability and verifiability

Business transactions must be traceable and verifiable by an expert third party, in particular by tax authorities, within a reasonable period of time. This includes the clear assignment of documents to business transactions and consistent documentation of processes.

Order and systematics

Archiving must be carried out in an orderly, systematic manner. Disorganized or unsystematic filing without a clear structure, naming convention, or search capability violates the requirements of the UGB and BAO. Documents must be quickly retrievable and clearly identifiable.

Timely recording

Business transactions must be recorded and documented in a timely manner. Arbitrary delays in document recording or archiving are not permitted, as they can impair the traceability and evidential value of the documents.

Immutability

Once archived, documents may not be altered or deleted without notice. Changes must either be technically impossible or documented in a fully traceable manner. The original document must remain reconstructable at all times.

Retention obligation and availability

According to the BAO, books, records, and documents must generally be retained for 7 years, and in certain cases for longer. During this entire period, the documents must be fully available, legible, and presentable in Austria at any time.

Retention periods in Austria:

- For most documents 7 years: invoices, accounting documents, annual financial statements, business letters, tax-related documents of all kinds, etc.

- Exceptions: in some cases, extended periods apply (e.g., documents relating to real estate).

What does archiving according to GoBD mean in Germany?

The GoBD defines similar requirements for the electronic processing and archiving of tax-relevant documents:

Traceability and verifiability

All business transactions must be documented in such a way that an expert third party can understand and verify their content within a reasonable period of time. This includes a transparent filing structure, clear assignment of documents, and complete logging of processing steps, changes, and accesses.

Completeness

All tax-relevant documents must be recorded and archived in full. No documents may be missing or removed retrospectively. This applies regardless of whether the documents were created digitally or digitized from paper documents.

Accuracy

The archived documents must correspond to the actual business transactions. Content must not be falsified or altered. Incorrect documents must not be overwritten, but must be supplemented with correctly documented corrections.

Timely posting

Business transactions must be recorded and archived in a timely manner. The GoBD requires that postings and document filing not be arbitrarily delayed. The aim is to prevent manipulation through subsequent recording or postponement of documents.

Order

Documents must be archived systematically and clearly. Chaotic filing, for example without clear naming, structure, or search options, contradicts the GoBD. The order must be designed in such a way that individual documents are clearly identifiable and can be found quickly.

Immutability

Once a document has been archived, it may no longer be changed or deleted without notice. Changes must be technically impossible or at least fully logged. The original document must remain recoverable at any time in order to ensure its evidential value.

Retention periods in Germany:

- 10 years: Booking receipts, invoices

- 6 years: Business letters

GDPR-compliant archiving

Digital archiving must also comply with data protection regulations. Important factors include:

- Purpose limitation

- Access restrictions

- Protection of personal data

- Defined deletion concepts after expiry of retention periods

GoBD and GDPR are not contradictory, but require clear processes, especially with regard to the right to erasure.

Which Documents Should be Archived?

Documents relevant to tax law and all documents relating to business management must be archived. This definitely includes:

- Incoming and outgoing invoices

- Delivery notes

- Accounting documents

- Contracts

- Business letters

- Travel expense reports and expense accounts

- Time sheets

An automated invoice processing system with subsequent automated archiving is particularly useful for document-intensive processes such as invoice or receipt processing.

Digital Archiving Process

Which Archiving Software is the Best?

The following factors are crucial when selecting the right system:

- Legal compliance

- Integration capability

- User-friendliness

- Support & Service

A document management and ECM system such as that offered by free-com combines audit-proof archiving with clear processes, automation, and efficiency.

FAQs: Frequently Asked Questions About Digital Archiving

Do you have any questions for us?

We will be happy to consult you during a short, non-binding online appointment!