Screenshots

Screenshots

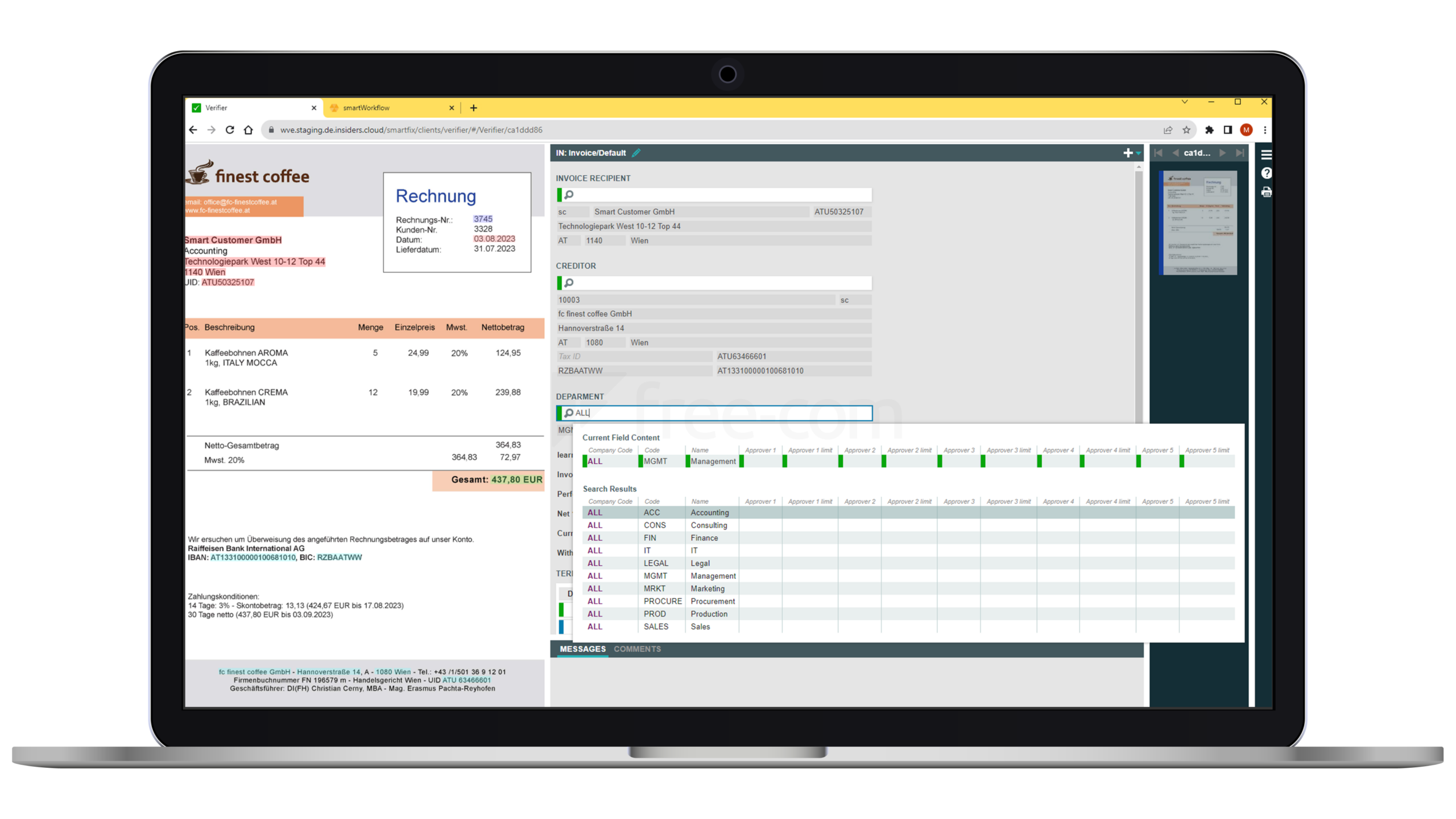

Always Stay Informed

You use an intuitive user interface that allows you to quickly find the desired information and keep track of the current status: with integrated invoice display, case-related chats, notifications, histories, and more.

Customer-Specific Logics

The solution can be extended with customer-specific logics and tailored features. Workflows, approval limits, deputy rules, etc., can be easily adjusted.

Flexible from the Cloud

The cloud solution is scalable from 10 to 10,000+ invoices per day. Since its efficiency is also evident with a smaller number of invoices, this solution can be particularly interesting for (growing) SMEs.

Versatile

Integration is possible with all common financial and accounting systems, such as BMD, DATEV, Dynamics 365/BC, SAP S/4 HANA (Cloud), etc. In addition, all currently prevalent invoice formats are processed: ebInterface, XRechnung, EDI, etc.

Easily Accessible

Seamless integration into the Microsoft 365 environment/MS Teams allows for invoice approvals directly from the Teams interface. The entire workflow can be carried out location-independently, even from mobile devices, including Single Sign-On.

Efficient and Meaningful Automation

You will observe a significant reduction in time and cost, allowing you more time for important tasks. You will not miss any early payment discounts, and you will reduce the overall error rate in the process.

Data Extraction

Automated Data Extraction

Digitized invoices (PDF or scans) are automatically read using artificial intelligence and machine learning approaches. All relevant data is extracted without the need to train the system on specific layouts beforehand. The system is self-optimizing and learns with each operation.

After data extraction, the invoice and the corresponding entry in the user interface can be accessed. Here, alongside the integrated invoice display, you will find the extracted header and detail data at a glance, as well as a workflow history for better tracking of pending approval steps, including all responsible employees. Automatically generated allocation suggestions for expense invoices, which the system also improves with each entry, are already included. Pre-accounting and extracted data can be manually edited, allowing, for example, amounts to be split, tax codes adjusted, or invoices allocated to specific departments.

Review

Formal and Substantive Review

Intelligent data extraction includes a compliance check and not only examines legally relevant invoice characteristics but also the consistency of the amounts. Important steps for checking invoices are therefore already completed.

The system can recognize the majority of invoices fully and automatically transfer them to the next system without user interaction shortly after. Only in the case of anomalies are the invoices marked for manual review. In the subsequent workflow steps, the respective users also perform a substantive check, i.e., an examination of the accuracy of individual amounts or outstanding claims.

Approval

Approval and Authorization

The subsequent, customer-specifically preconfigured approval process is multi-tenant, multi-stage, and flexible to adapt to the company’s needs. Features such as direct chat functionality with mentions, automated reminders of important deadlines via email, or adding additional users ensure an organized and efficient process. For maximum flexibility, approvals can also be done from mobile devices, via email, and as bulk approvals. Moreover, approval limits and deputy rules can be defined.

To comply with the legally mandated documentation requirement, it is important to document all steps of the approval process and archive them together with the invoice. The entire approval process is documented, and an audit report is provided accordingly.

Posting

Account Assignment and Posting

In allocation, the accounting department determines which accounts the documents should be posted to. Account numbers and cost centers, invoice numbers, data, and booking memos are included. To support this process, the system learns the applied allocations in a smart way and suggests appropriate allocations. Often, the accounting department only needs to confirm these suggestions. The electronic invoice workflow enables seamless booking of documents into the respective FI/CO or ERP system, including but not limited to BMD, DATEV, Dynamics 365/BC, or SAP S/4 HANA (Cloud).

e-Archive

Legally Secure Archiving

From the time of invoice issuance until the end of the retention period (7 years in Austria), the authenticity of the origin, integrity of the content, and readability of an invoice (see GAAB) must be ensured. An exact replica is not required. Invoices, along with the documentation of the approval process (approval protocols), must be archived in a legally compliant archive system.