Order to Cash Process SAP

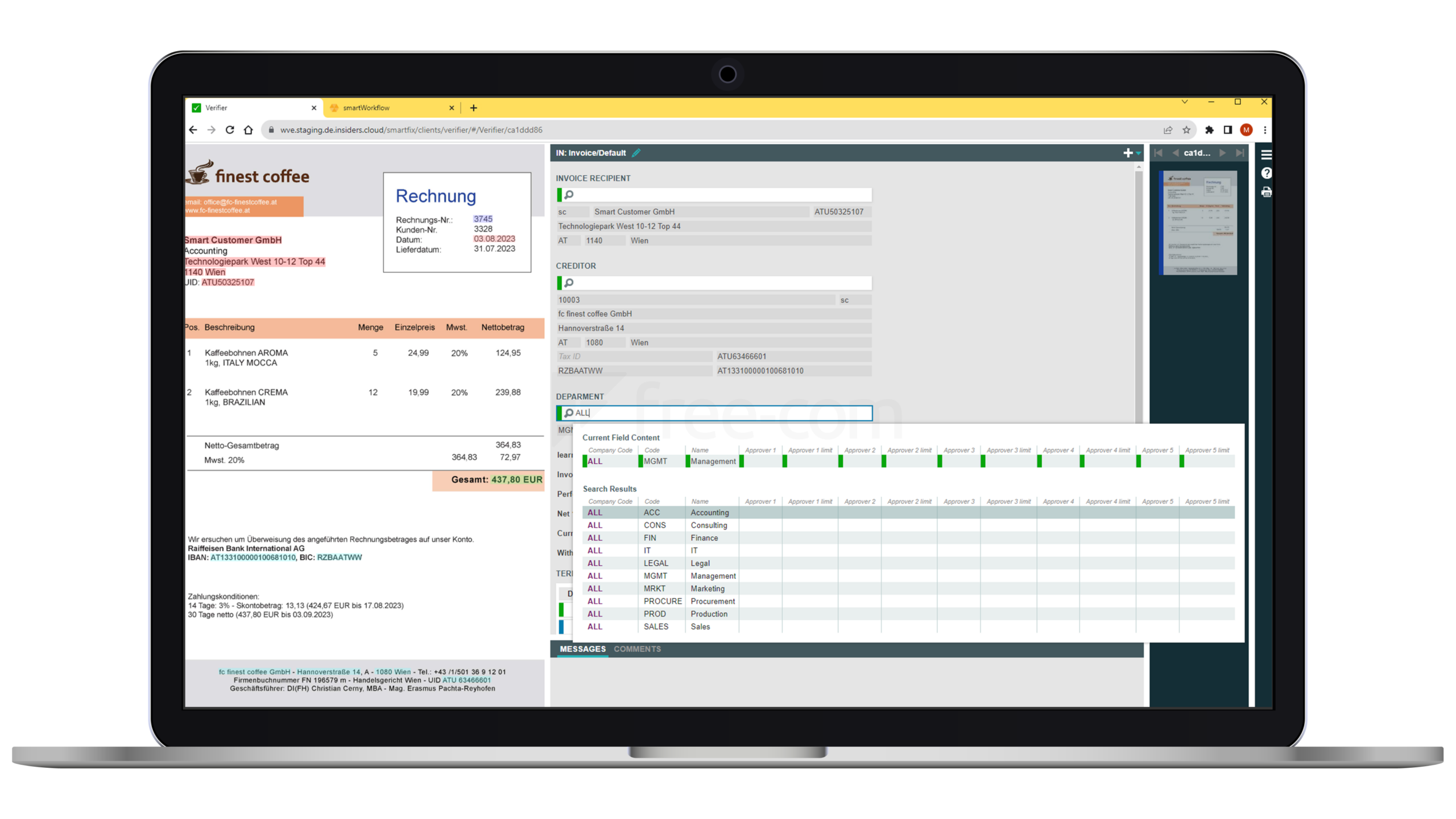

Screenshots of the SAP Invoice Solution

Advantages

The Advantages of the SAP Invoice Workflow

Fully automated booking

Invoices with a purchase order reference can be posted automatically, i.e. the invoice does not have to be approved, but can be posted directly without any additional effort. This saves an enormous amount of time when processing incoming documents.

Overview and Transparency

Thanks to comprehensive status tracking and an embedded workflow history, it is always possible to see where an invoice is in the process. Invoices no longer get stuck and every user can see the latest status quo.

Reduction of Errors

Automated checks and approval processes minimise potential sources of error in data transfers, manual checks, etc. The accounting department benefits from more reliable information and correct postings.

Easily Accessible

Seamless integration into the Microsoft 365 environment / MS Teams enables invoices to be approved directly from the Teams interface. The entire workflow can also be carried out from mobile devices, regardless of location. Single sign-on included.

Flexible as Cloud Solution

The cloud solution is scalable from 10 to 10,000+ invoices/day. As it can also be used efficiently for a smaller number of invoices, this solution can be particularly interesting for (growing) SMEs.

Meaningful Automation

You will see a significant reduction in time and costs, giving you more time for more important things. You will no longer miss any discount deadlines and generally reduce the susceptibility to errors in the process.

Receipt

Reading Incoming Invoices

The order to cash process in SAP begins with intelligent data extraction from incoming invoices. Using modern technologies such as AI, OCR (Optical Character Recognition) and machine learning, all relevant data is automatically extracted from the invoice. Among other things:

- Order number: The order number is used to allocate the invoice to an existing order

- Delivery note number: If available, the delivery note number is extracted to track the delivery

- Invoice amounts: all gross and net amounts on the invoice

- Tax information: The tax shown on the invoice is automatically identified and assigned

- Supplier data: Information about the supplier such as name, address and bank details

After data recognition, the system automatically decides whether it is an MM invoice (Material Management) with a purchase order reference or an FI invoice (Finance) without a purchase order reference. MM invoices need to be compared with the purchase order, whereas FI invoices can be processed directly.

Assignment

Assignment of the Workflow

Once the data has been successfully extracted, the invoices are sent to the SAP inbox. Each invoice is identified uniquely in order to organise the subsequent process. In the dispatching process, a decision is made as to which department or employee is responsible for further processing of the invoice. This can be done in two ways:

- Automatic assignment: Based on predefined rules, such as suppliers, order numbers or departments, the invoice is automatically forwarded to the appropriate workflow

- Manual assignment: In cases where no automatic rule applies, an administrator or clerk can manually assign the invoice to the corresponding user or process.

Approval

Digital Approval Workflow

The approval workflow is a central component of the SAP invoice workflow and varies depending on the type of invoice:

Invoices with purchase order reference (MM invoices):

Invoices with a purchase order reference are subject to a three-way match. This means that the purchase order, the delivery note and the invoice are compared with each other. This comparison ensures that:

- The quantity shown on the invoice corresponds to the quantity ordered and delivered

- The price on the invoice matches the price on the order

- The delivery was carried out in accordance with the agreements

If discrepancies are detected, the system automatically informs the responsible persons for a manual check. The invoice is automatically assigned according to the original order.

Invoices without a purchase order reference (FI invoice):

The system proposes an automatic account assignment for invoices without a purchase order reference. This is based on predefined account assignment rules and historical data. The user has the option of checking the proposed account assignment and adjusting it if necessary. The workflow also checks whether the invoice exceeds certain value limits. If this is the case, additional authorisation steps are initiated.

Posting

Posting the SAP Invoice

Once the approval workflow has been completed, the SAP incoming invoice is posted.

Invoices with a purchase order reference:

Invoices that are linked to a purchase order are posted in MIRO. This transaction enables the entry of goods receipt and invoice data and automatically links the purchase order and invoice. If the three-way match shows no discrepancies, the invoice can be posted automatically without the need for manual approval.

Invoices without a purchase order reference:

Invoices without a purchase order reference are entered in FB60. The user enters the required data, such as the account to be debited and the amount, and then posts the invoice.

Digital Archiving

Audit-proof Archiving

The final step in the electronic invoice workflow is the audit-proof archiving of documents. All suitable digital archiving systems can be used for this with the ArchiveLink interface, such as Microsoft SharePoint with our AuditProof add-on. This means that:

- All archived documents are protected against retrospective changes

- All invoice processing steps are seamlessly logged and can be traced at any time

- Archiving fulfils all legal requirements, particularly with regard to retention periods and obligations to provide evidence

This archiving ensures that companies can access invoice documents at any time, for example during audits or in the event of complaints.