Smart (travel) expense reports

Automating (Travel) Expense Reporting

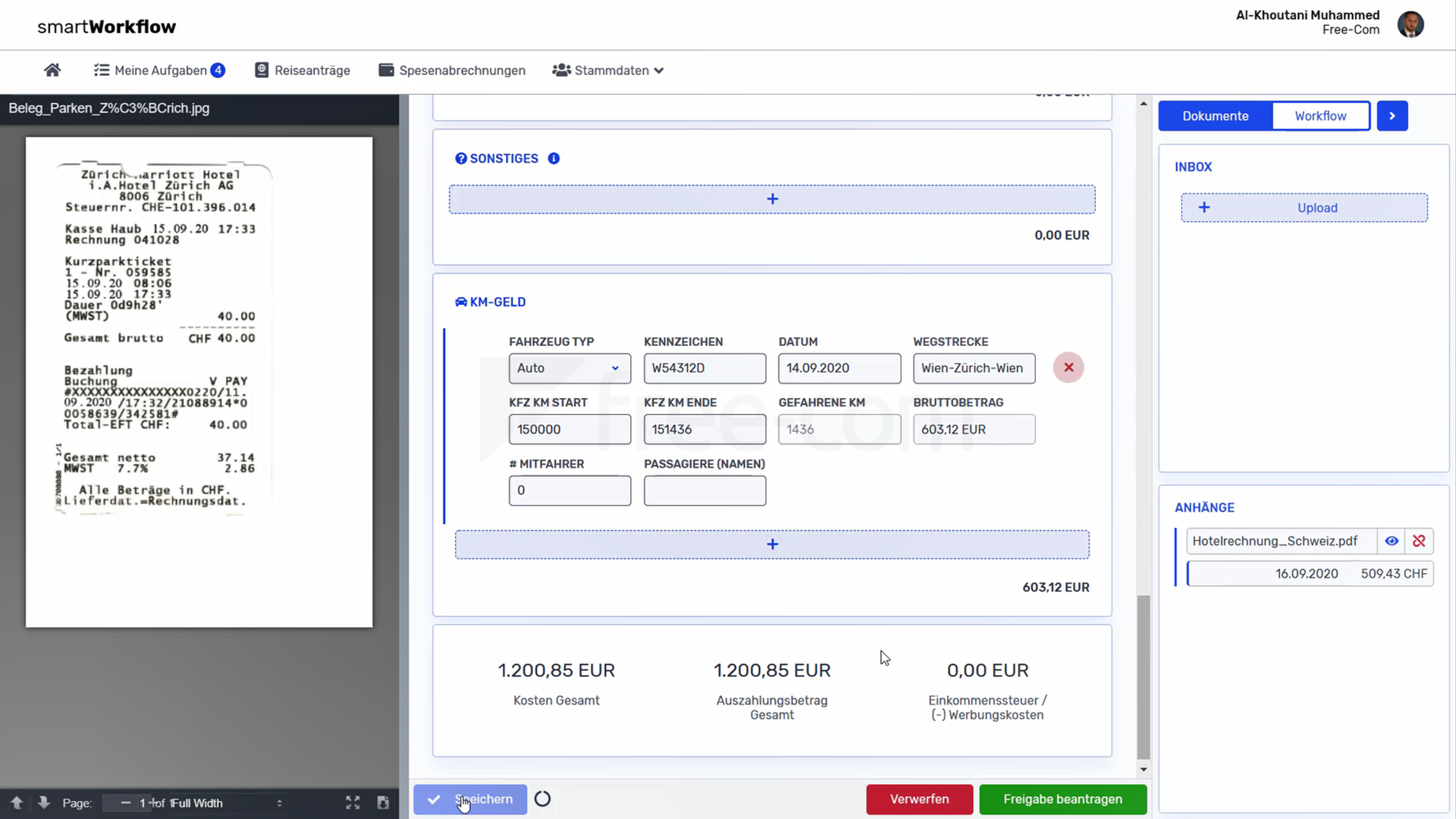

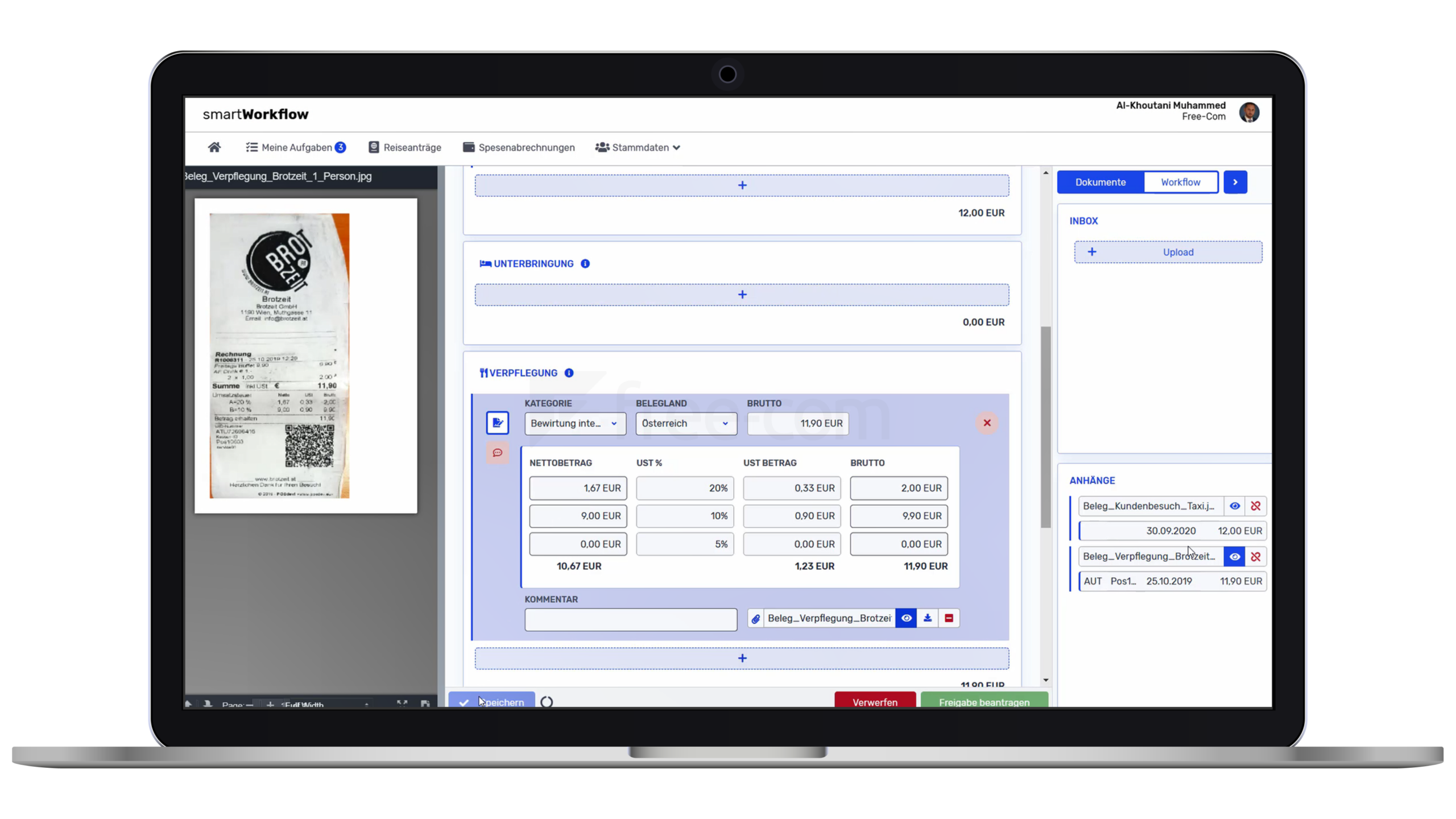

Replace physical receipts with mobile photos: with electronic (travel) expense reporting, you can digitally submit and approve your invoices. All relevant data is automatically extracted, and additional expenses (such as mileage) are calculated in just a few clicks. Pre-configured approval workflows make it quick and easy to review travel requests and expense reports.

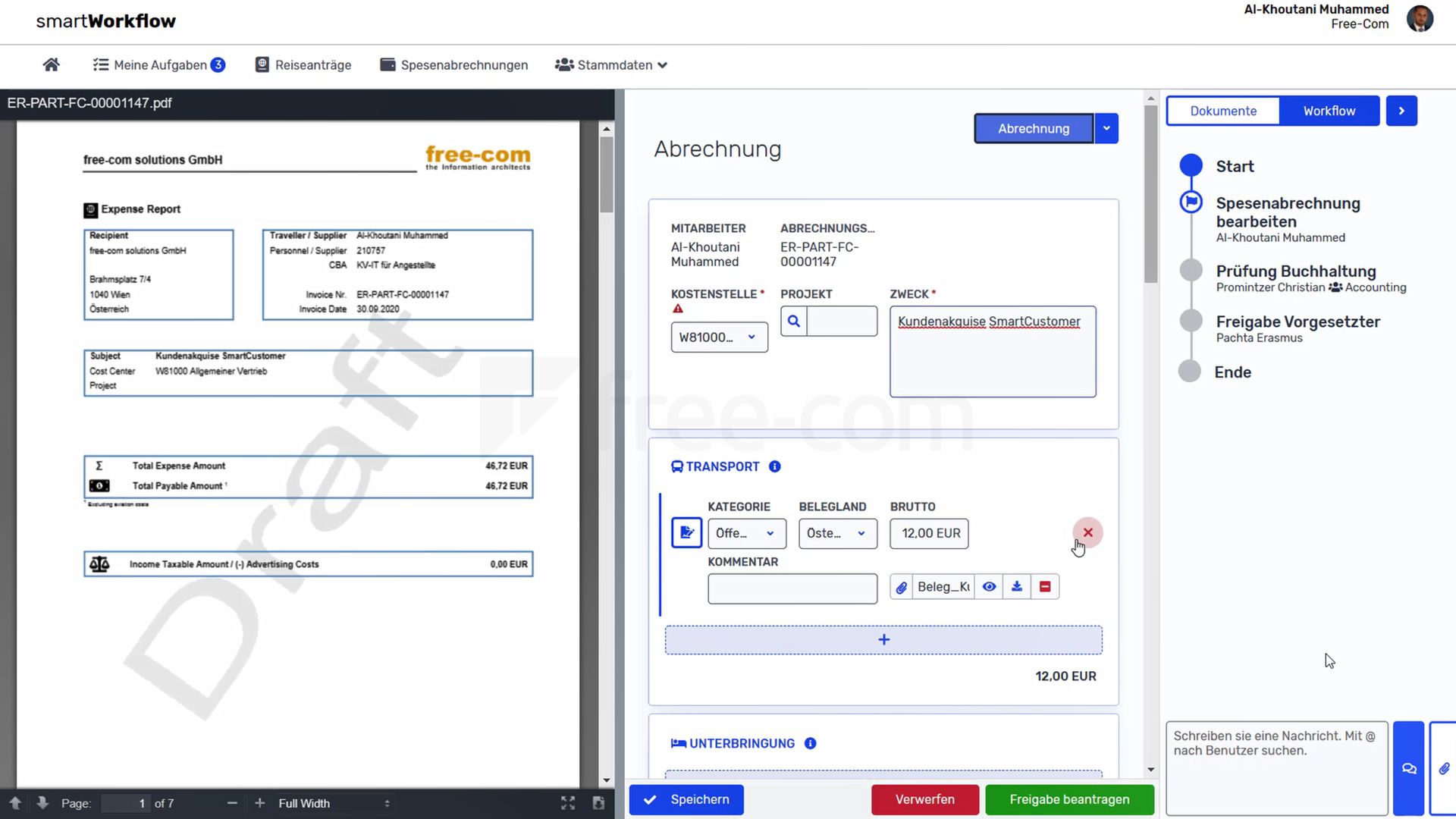

Workflow

Automate (Travel) Expense Reporting

Benefits

All Advantages of Digital (Travel) Expense Reporting

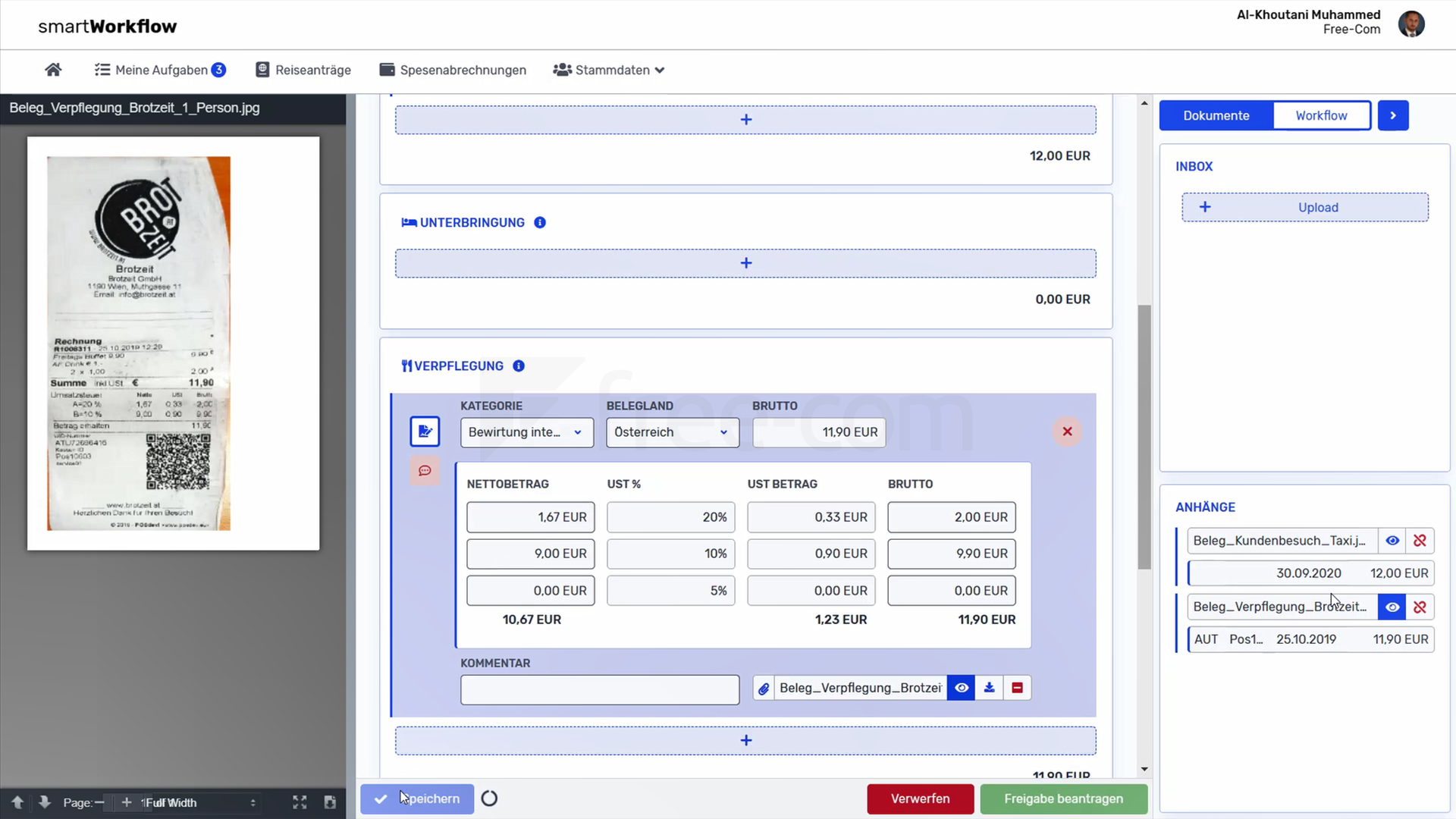

Expense Reporting

Digital Expense Reporting

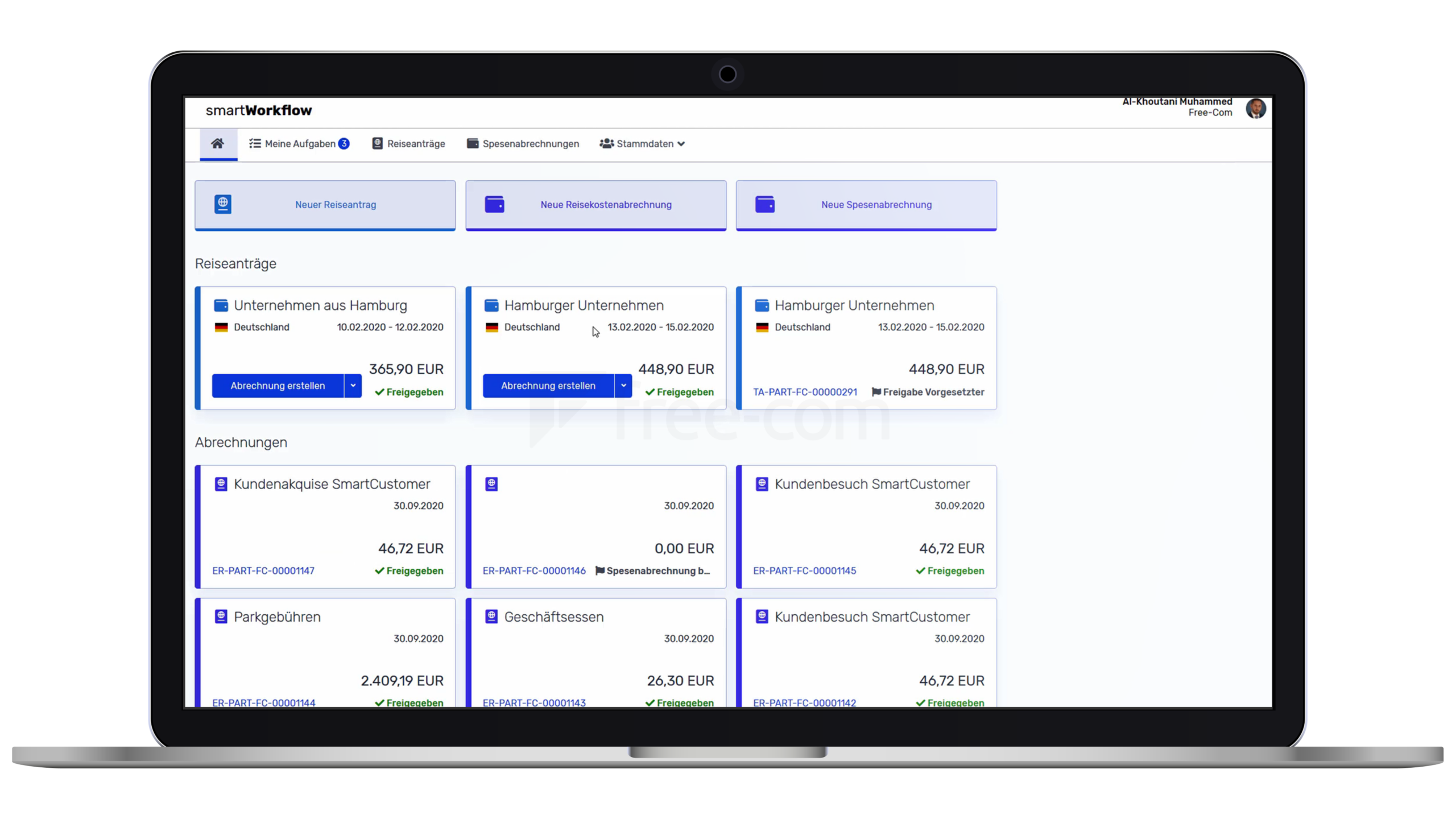

Excel spreadsheets, long-term storage of individual receipts, printing, stapling, and other tedious steps are a thing of the past. With automated expense reporting, receipts are photographed and stored in your account via email. You can easily finalize the report at a later time. Clear approval processes and simple communication options ensure a smooth workflow from request submission to approval by supervisors.

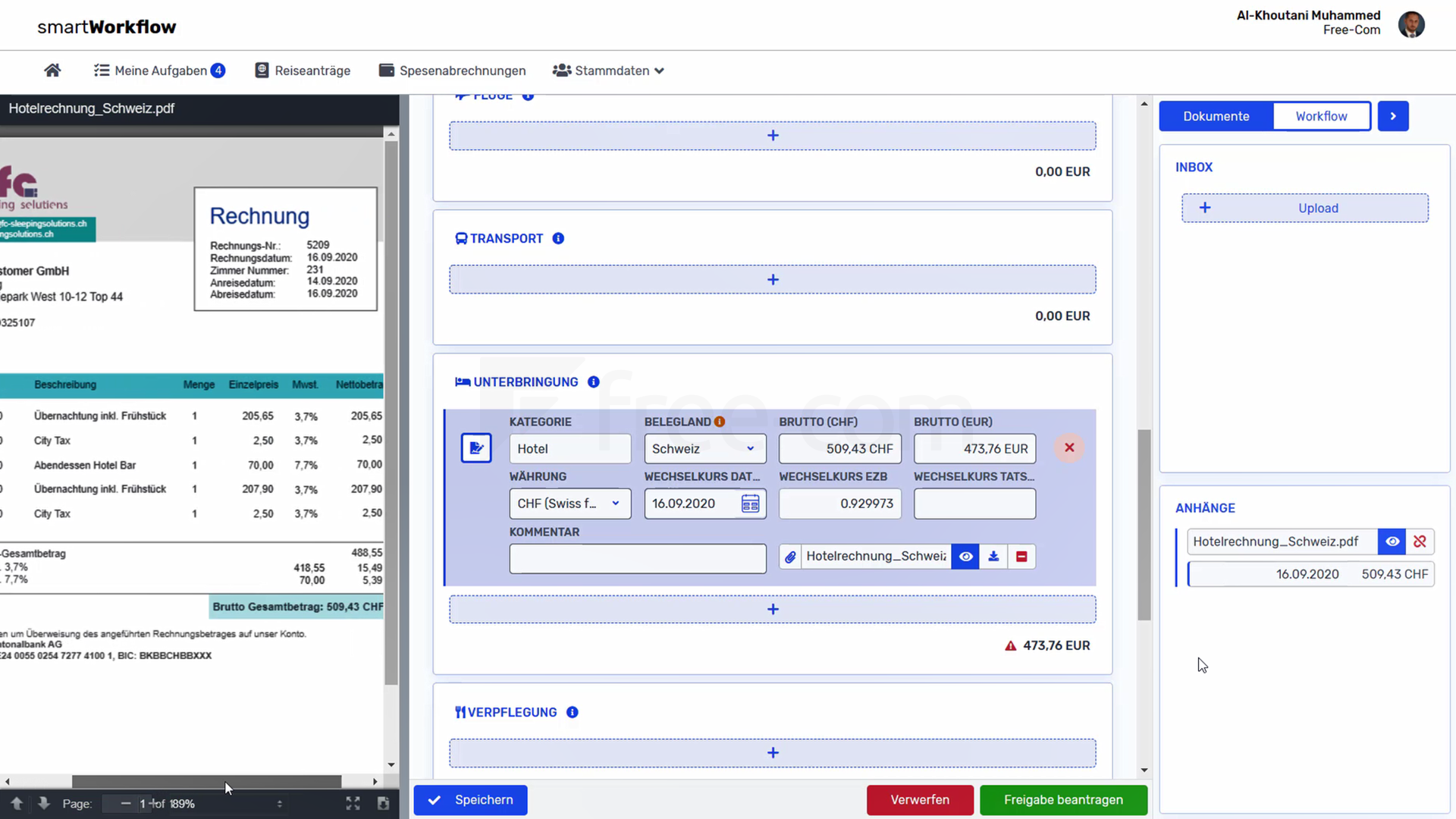

Travel Expense Reporting

Automate Travel Expense Reporting

Automated travel expense reporting allows you to easily store receipts incurred while on the go and process them later (independently of location). Responsive expense report templates and automatic calculation of exchange rates, per diems, and mileage reimbursement greatly reduce the effort.

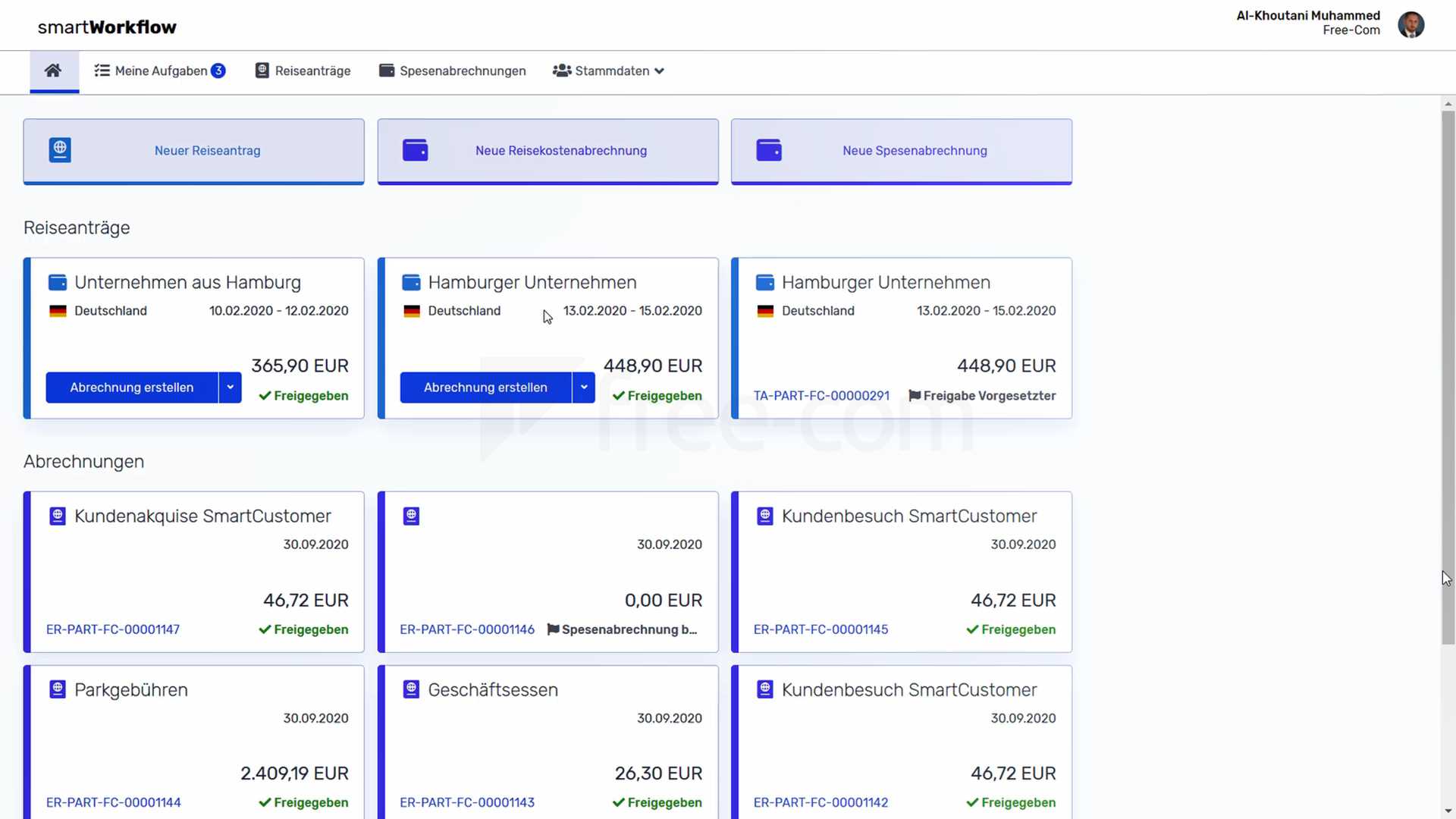

Travel Requests

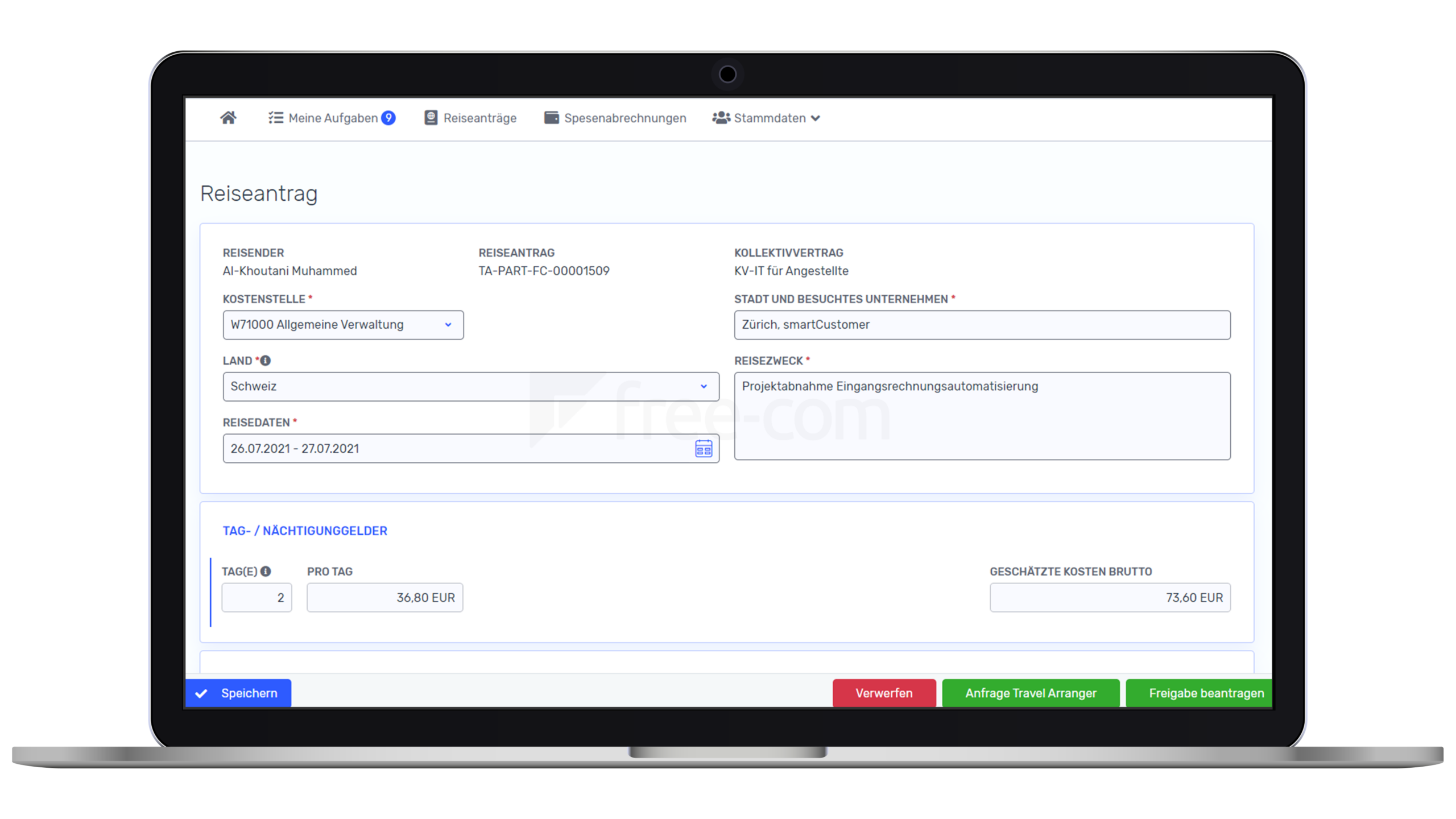

Centrally Organize Business Trips

All information about an upcoming trip, such as reservations, tickets, or expenses, is centrally accessible and can be quickly viewed by relevant individuals. Supervisors gain maximum visibility into travel budgets, planned costs, and other parameters. Travel arrangers can organize trips much more easily and communicate effectively. Employees have access to the current status and all trip documents, even from mobile devices.

Integrations

Seamless integration into common Accounting/ERP systems

Among others: