Process Incoming Invoices Automatically – What is the Right Approach?

Published: March 29, 2022

Reading Time: 6 min

The topic of e-invoicing

In many companies, invoices are still processed manually and with a lot of effort. But just why is that? It is no longer necessary to process invoices in paper form. A purely digital processing, from receipt to archiving, is even comparatively easy to implement. Why do some companies still hesitate to introduce digital invoice processing?

For one thing, the investment costs can be a deterrent, especially for smaller SMEs that are not yet sure which league they are in. This concern will quickly subside when the costs are contrasted with the enormous savings potential: up to €15 [1] can be saved by digitising the process. On the other hand, the decision for the infrastructure used must make sense in the long term and meet the company’s requirements. The decision on which system to implement must therefore be well-considered. And also what exactly is to be achieved with digitisation. After all, not every digitalisation makes actually sense and, especially in the case of incoming invoice processing, a focus on purely quantitative parameters is too narrow.

According to the Pareto principle, 80% of the total output is achieved in only 20% of the time. The remaining 20%, however, devour 80% of the time.

When does digitisation make sense?

The principle can be transferred to incoming invoices: 80% of invoices are processed quickly and do not pose any problems. The remaining 20% are subject to changes, special regulations or other circumstances. Accordingly, the supposedly small amount of invoices causes most of the effort. Why is this important?

If you concentrate on the mass of incoming invoices, i.e. on the 80% of the incoming “simple” invoices, it sounds like a great success at first. But in reality, only 20% of the effort has been saved, and the special cases requiring intensive support continue to cause the majority of the working hours. The project then leads to dissatisfaction because the desired results do not materialise. And in view of the investment costs, it is not uncommon for the project to be abandoned and dropped at this point.

So why not try to automate the complicated cases right away? Especially if their number is high.

It is important to know what goal one wants to achieve with digitalised incoming invoice processing. If one is clearly aware here of the possibilities offered by the various technical infrastructures and how they can be optimally used in one’s own interest, the first prerequisites for a successful project have been created.

Structure data with EDI and XML

Structured data or formats are transferred directly and in machine-readable form to the recipient’s system, manual processing is no longer necessary. EDI is often equated with the term EDIFACT (Electronic Data Interchange For Accounting, Commerce and Transport), but it is only one of several EDI standards. It was developed in the 1970s for the transmission of electronic invoices in the B2B sector and is now mainly used in commerce. It has not been able to gain widespread acceptance because the data must be defined separately with each business partner and assigned in the system. This discourages small entrepreneurs because the introduction is disproportionately expensive compared to other formats – but also large entrepreneurs who have to reckon with a considerable effort due to many varying bilateral business relationships.

Structured data is exchanged in XML format (Extensible Markup Language); the information is machine-readable, but can only be read by humans with difficulty or after appropriate training. XML is widely used and is the basis for exchanging invoices with the respective authorities in many countries. The format can be transmitted as a single file or, for example, integrated into a PDF/A-3 and thus also be machine-readable.

Hybrid ZUGFeRD

ZUGFeRD (“Zentraler User Guide des Forums elektronische Rechnung Deutschland”) is a hybrid invoice format consisting of a PDF/A-3 and an XML file. It is therefore both machine-readable and easily readable by humans and is thus intended to combine the diverse requirements of the different sides. ZUGFeRD is available in different versions and profiles, the current version is ZUGFeRD 2.1.1 (as of 03/21).

ZUGFeRD 2.0 is identical to XInvoice in terms of content, but there is one important difference: Permissible syntaxes for electronic invoices are the XML schemas UBL (Universal Business Language) and CII (Cross Industry Invoice) – while XInvoice can be implemented in both, with ZUGFeRD this is only possible in the syntax CII. Since the July 2020 update, however, ZUGFeRD has been supplemented by an XInvoice profile and can now also be sent as a pure XML file.

ZUGFeRD also corresponds to the French Factur-X in terms of content.

The formats listed here are increasingly being used and will play a major role in the processing of invoices in the future. However, they do not yet function comprehensively and across the board, which is why PDF invoices still play the biggest role, especially for smaller companies.

So an efficient solution is needed here that can meet the current requirements and at the same time flexibly adapt to growth and further development. In these cases, this is often the best solution: Automatically read out the contents of the invoices with AI.

Data Extraction with AI

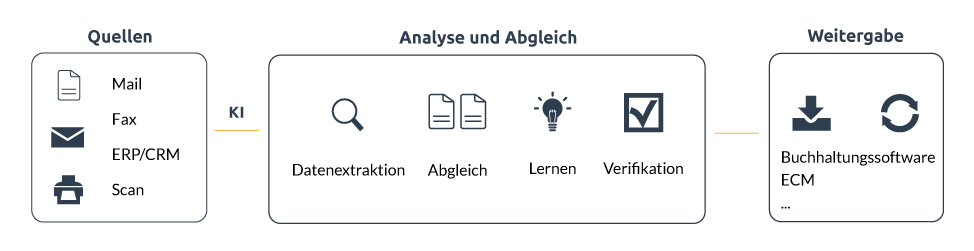

In this third option, incoming PDF invoices or scanned receipts are read by means of OCR and all relevant invoice data is extracted in structured form. The great advantage of this variant is its independence from the infrastructure and procedures of other companies; there is no need to coordinate the solution used. Incoming invoices are processed automatically and based on the approaches of artificial intelligence and machine learning.

This approach can have numerous further positive influences on the entire business processes, as Bruno Koch explains for Billentis: “Organizations may benefit from machine learning in numerous ways. They will be able to accelerate and optimise their business processes in general, and invoice processing in particular. Machine learning may simplify user interactions with devices, reduce human intervention, support fraud detection, forecasting liquidity, dynamic pricing, customer complaint resolution, trading partner scoring, and spend management.”[4] Intelligent, self-learning systems pave the way for a wide range of optimisations in very different (specialised) disciplines.

Summary

For the exchange of electronic invoices, the transmission of structured data is the optimal way – in theory. In practice, however, there are many obstacles. Several formats such as EDI, ebInterface, ZUGFeRD, but also diverging demands of small and large businesses and different financial resources make a quick and comprehensive conversion to electronic invoices difficult.

Reading invoices with AI can therefore be the most flexible and efficient solution, which will also adapt to the growth and further development of your company.

Checklist for the planning phase

Do you have any questions for us?

We will be happy to consult you during a short, non-binding online appointment!

Sources:

1, 2, 3: Pagel, P. (10/2019). Bei der Übermittlung und Verarbeitung elektronischer Rechnungen müssen die geltenden Anforderungen zu Datenschutz und Datensicherheit erfüllt sein. Wirtschaftsinformatik & Management 11, p. 342-346. doi:10.1365/s35764-019-00201-w

4 Koch, B. (09/2019). The e-invoicing journey 2019 – 2025. Von www.billentis.com: www.billentis.com/the_invoicing_journey_2019-2025.pdf abgerufen