8 Benefits of Digital (Travel) Expense Reporting

Published: April 17, 2023

Reading Time: 4 min

Contents

Inhalt

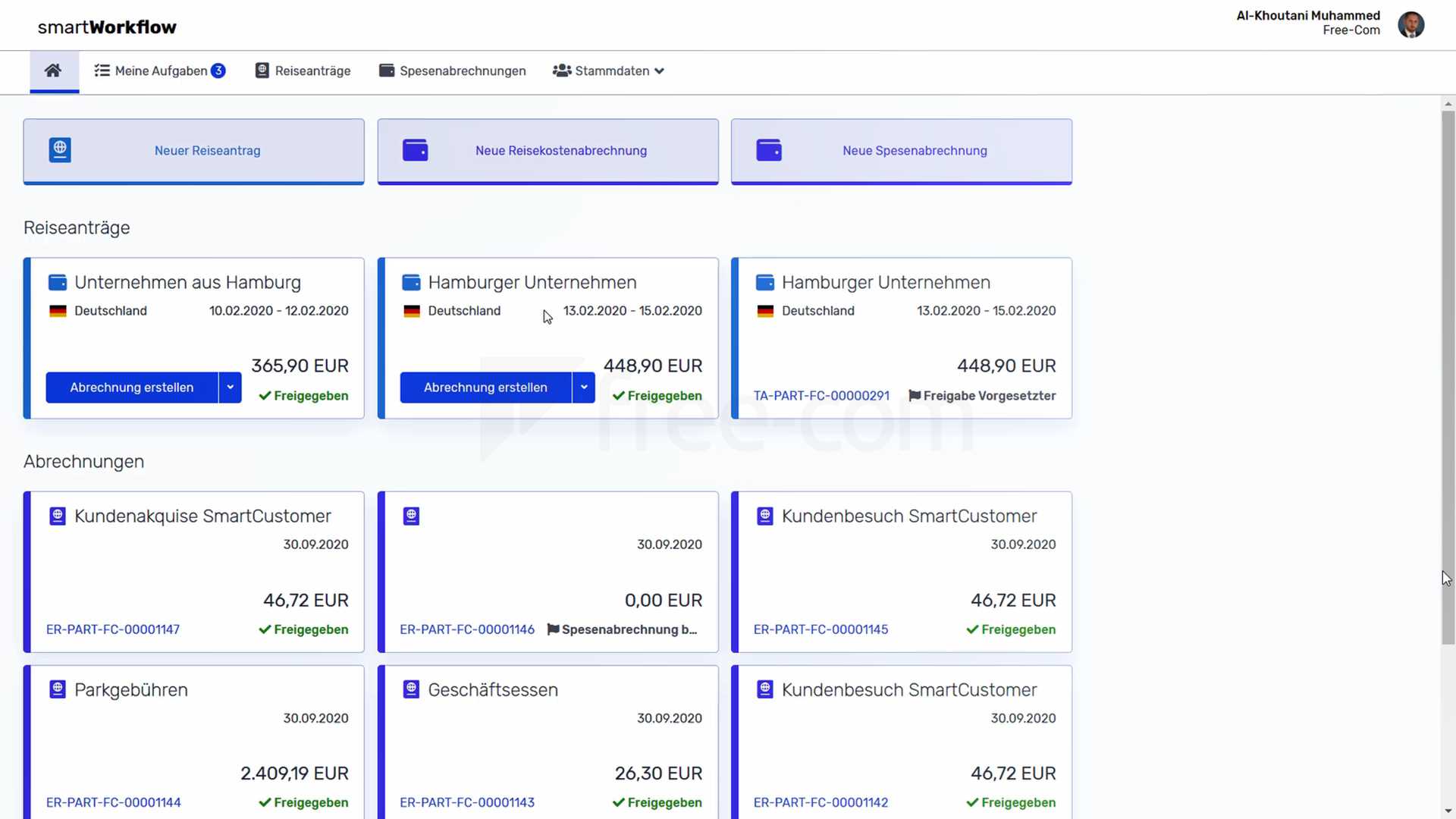

The digital, automated processing of travel costs and expenses in companies has gained in importance in recent years. Instead of keeping receipts, transferring them to Excel lists, tediously calculating per diems and mileage allowances, and physically passing applications around for approval, the relevant data is automatically extracted from the receipts and processed completely digitally in the subsequent process. Some companies hesitate: outdated manual processes are retained out of habit, the advantages of digitisation are pushed away out of uncertainty.

That’s why it’s worth taking a closer look at the numerous benefits that come with electronic travel and expense accounting.

1. Save time and expenditure

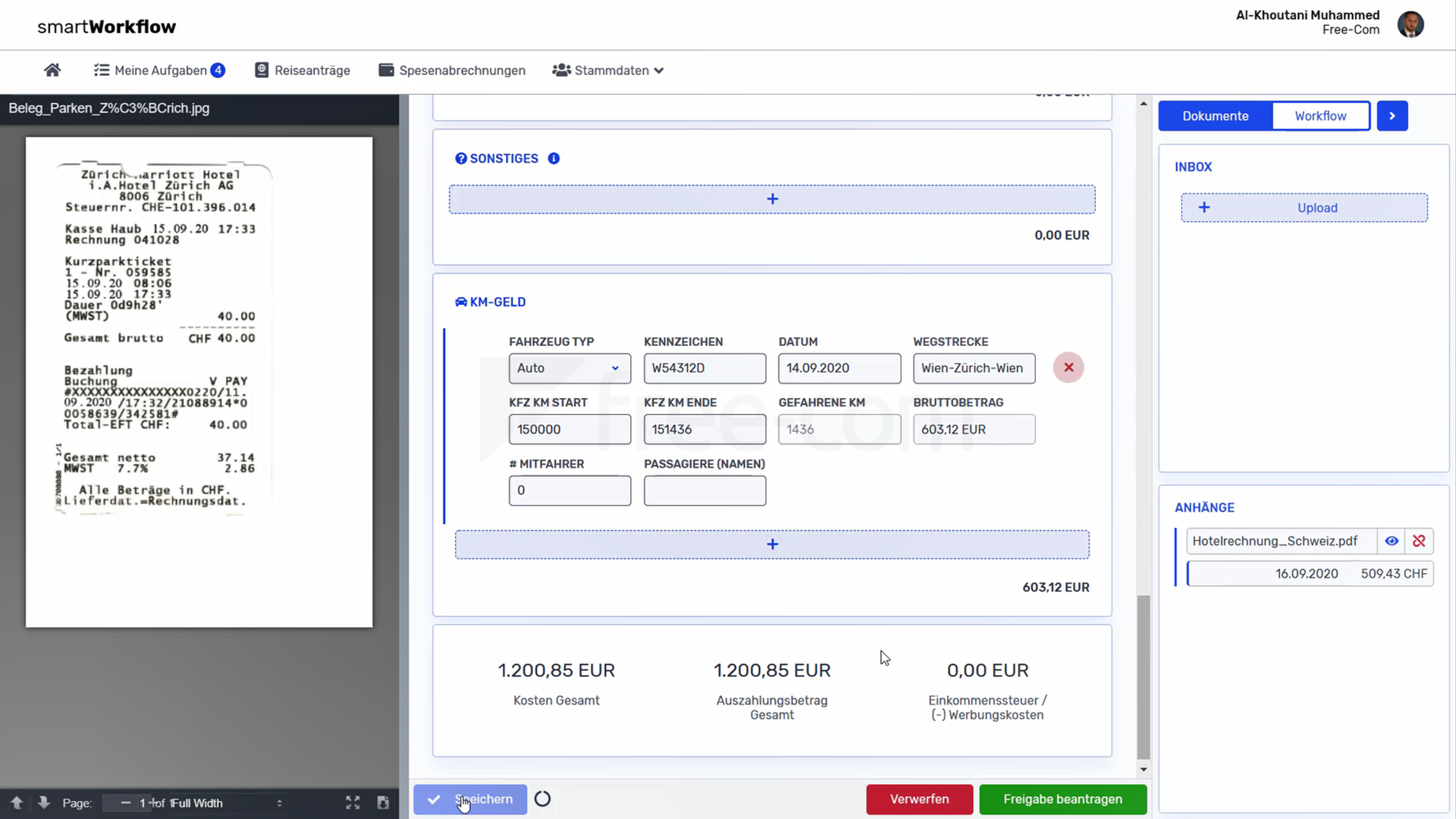

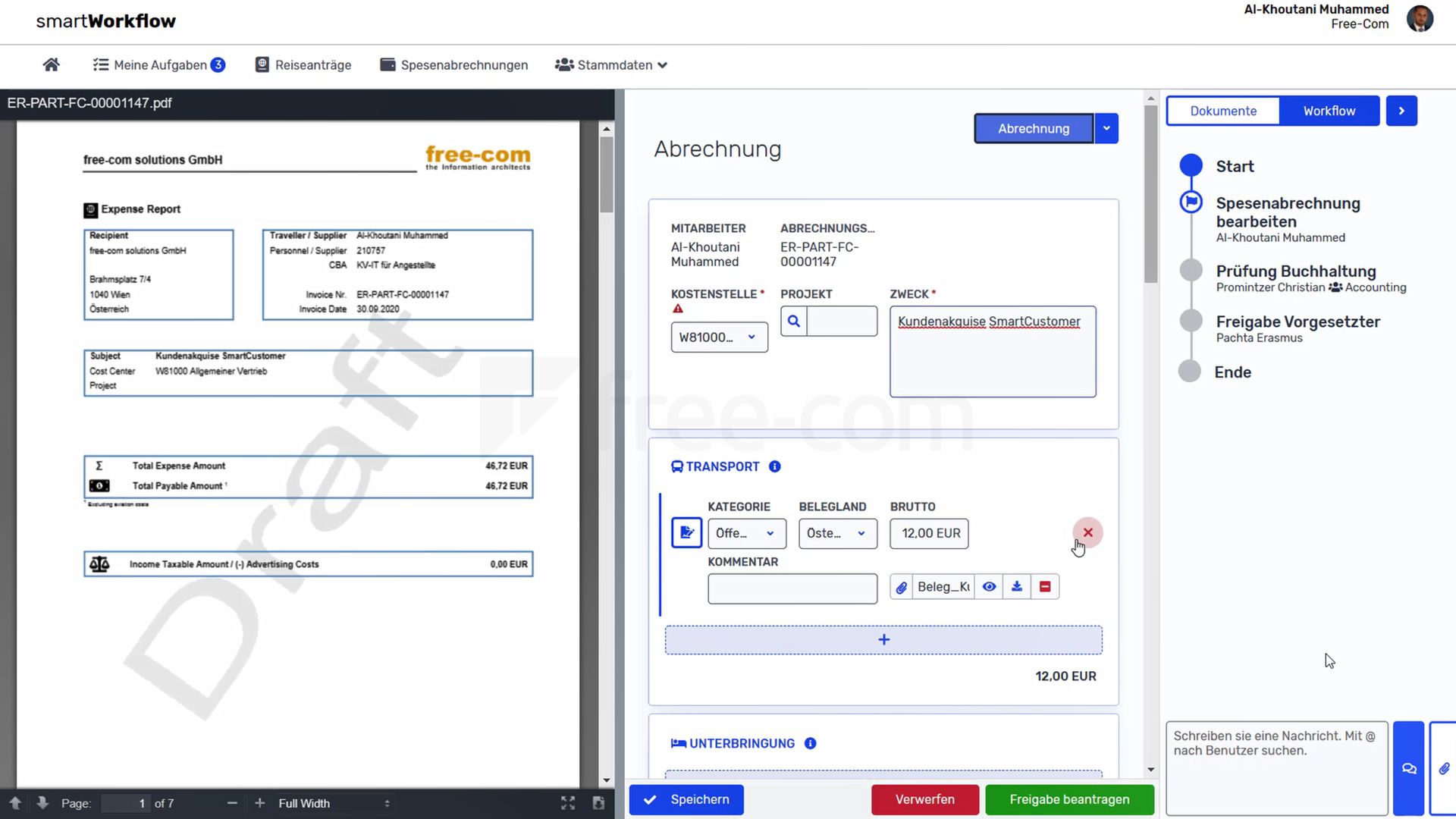

One of the biggest benefits is the significant time and resource savings that come from automating the the process. Manually carrying out the data extraction, verification and invoicing of receipts is time-consuming and prone to errors. By using appropriate solutions such as smartExpense, companies can automate these processes, i.e.: Data is automatically extracted, amounts are checked for consistency, validity and compliance, reimbursable costs are calculated and the individual approval workflow for the receipt /employee is started.

This considerably reduces the administrative effort and the company can use the saved resources for more important tasks.

2. Transparency and Control

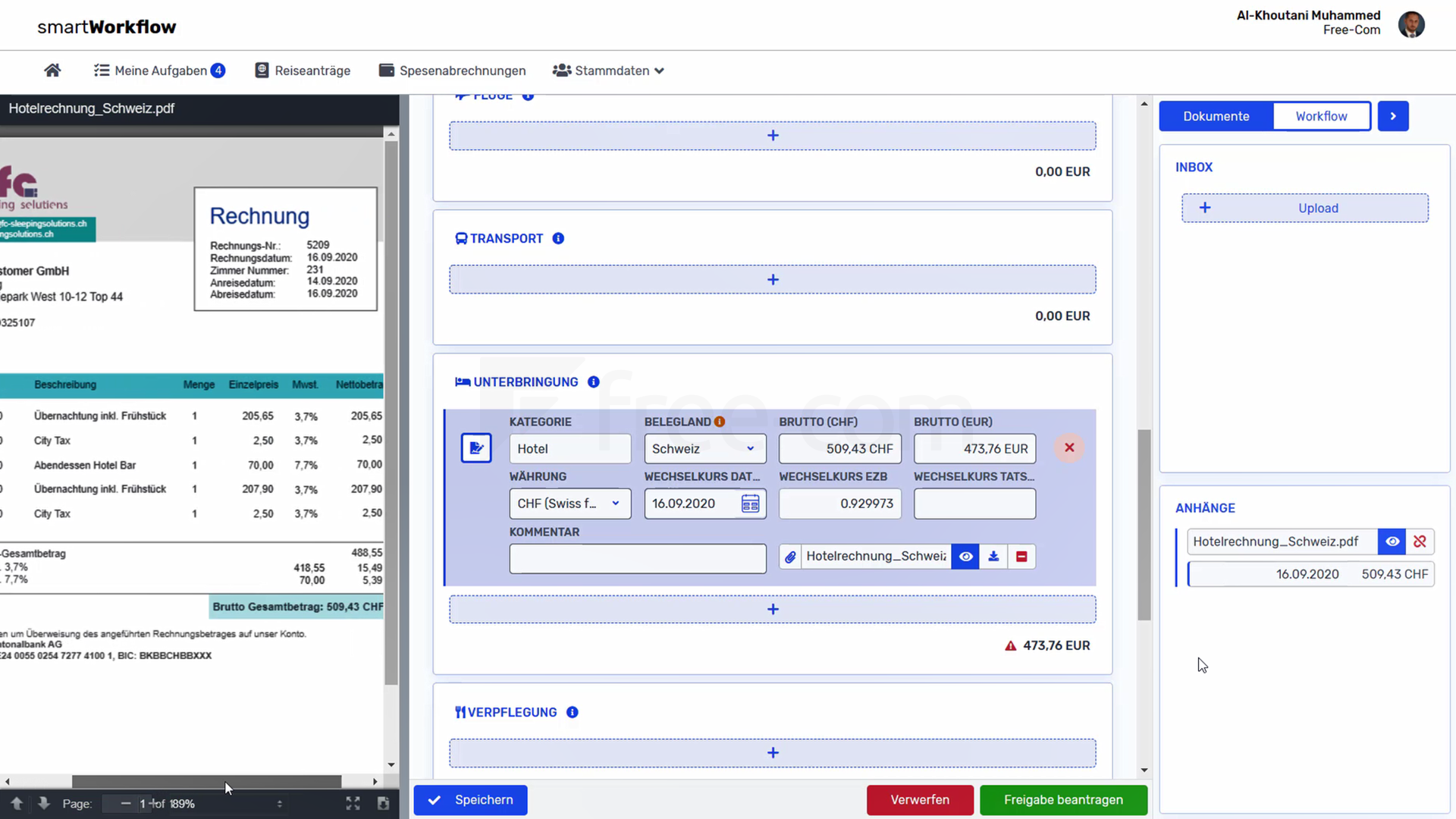

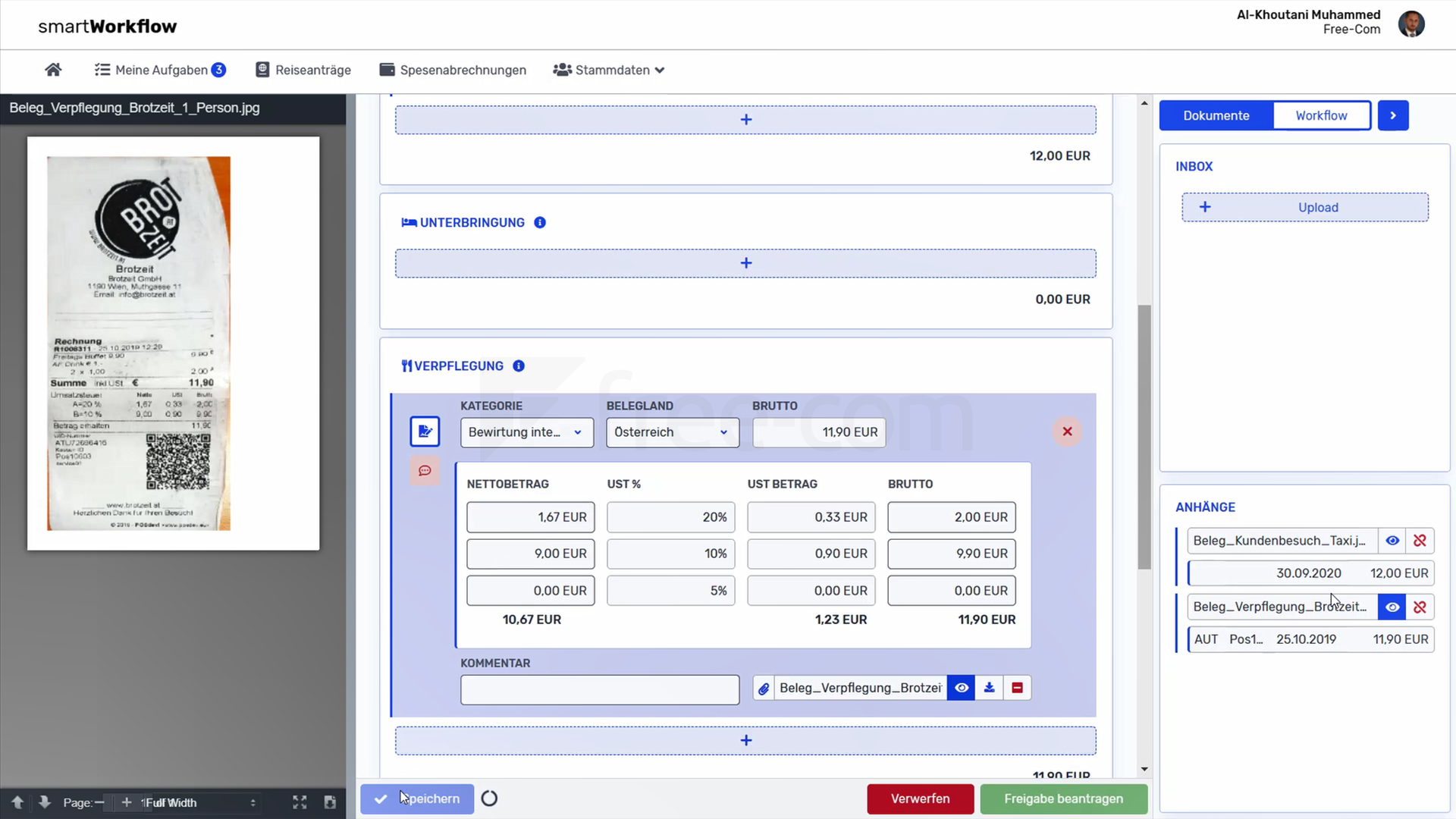

Digital solutions make all information related to an expense report and its approval process clearly comprehensible. Receipts can always be called up in the attachment, a workflow history and the integration of a direct communication channel make the process much easier. This creates more transparency and control for all employees, travel agents and decision-makers involved. Communication and trust between employees and the company benefit from this.

3. Reduction of error sources and processing times

Analogue processes for recording costs are prone to errors. Receipts can be lost or recorded incorrectly, and the manual calculation of reimbursement amounts can lead to errors. An analogue process is also more easily delayed or perhaps comes to a complete standstill if it is unclear where and with whom the approval has been left. These sources of error can be avoided through digital accounting. The turnaround times of documents are enormously reduced by the high transparency in the process, but also by aids such as mail notifications, workflow histories, mentions, chat options, approvals directly from mails, mass approvals or even automated target-actual comparisons and other functions.

4. Improved Compliance

A good solution automatically checks compliance with tax regulations and internal guidelines such as travel policies to ensure that all expenses are correctly recorded and accounted for. This helps companies minimise potential risks and avoid possible penalties.

5. Better control and data analysis

Companies can access data and reports that give them a comprehensive overview of planned and incurred costs. They can analyse expenses by category, project or department to identify spending trends and patterns. This gives them better control and allows them to take action to optimise their costs. Comprehensive data analysis enables informed decisions and can greatly increase a company’s efficiency.

6. Improved user-friendliness and satisfaction

The right solution offers significantly improved user-friendliness for employees who need to record and account for their expenses. They can conveniently photograph their receipts as soon as they are received and deposit them by mail or even directly by drag & drop for later reporting. This way, invoices do not get lost and employees can take care of completing and submitting the report when they are back at their workplace.

This, in turn, is much less complicated, time-saving and efficient with the help of the responsive template and individually stored data, as manual data entry, calculations or even printing, stapling and gluing are completely eliminated. Relieved employees can use the time gained for more important tasks, productivity and satisfaction increase.

7. Intelligent Automation

Relevant data is extracted from the document, including various tax rates, gross/net amounts. Country and currency are also automatically recorded. The exchange rates valid on the day of the invoice as well as the contracts on which the calculation is based are also stored automatically and only have to be processed manually in a few cases. The work for the employees is thus reduced to a minimum and errors are avoided.

8. Pre-configured workflows and flexible templates

Responsive templates are available for specific travel data. Preconfigured workflows that can be extended with customer-specific logics support the approval process and adapt to the existing requirements. This guarantees that the solution meets the wishes and needs of the company and can actually support it optimally.

Conclusion

In summary, the introduction of an electronic travel and expense report such as smartTravel/smartExpense can give a company decisive advantages in its profitability, efficiency and control. Time and resource savings, reduced turnaround times, traceability of the entire approval workflow, sensible automation, reduction of sources of error, adherence to corporate guidelines/compliance, as well as better data analysis and cost control are just a few of the numerous advantages that result from the digitalisation of the accounting process. Employees benefit from a much simpler accounting process, decision-makers from easier approvals, a better overview and more control. The company implements a promising solution, strengthens its competitiveness and will feel the positive effects far beyond the actual core process.

Do you have any questions for us?

We will be happy to advise you in a short, non-binding online appointment!